My scholarship focuses on the frictions and decision-making processes that affect how financial and human capital (i.e., money and workers) are allocated throughout the economy. My three main research areas of interest are: (1) the role of financial frictions in climate finance, (2) individual and institutional investor decision-making, and (3) labor and finance.

Working Papers:

1. A Flash in the Pan(demic)? Migration Risks and Municipal Bonds

with Matt Gustafson, Peter Haslag, and Zihan Ye

R&R at Management Science

with Matt Gustafson, Peter Haslag, and Zihan Ye

R&R at Management Science

Link to Paper

Summary:

Presentations: Remote Work Conference at Stanford (scheduled), FIFI @ S. Carolina (scheduled), AEA, FCMG

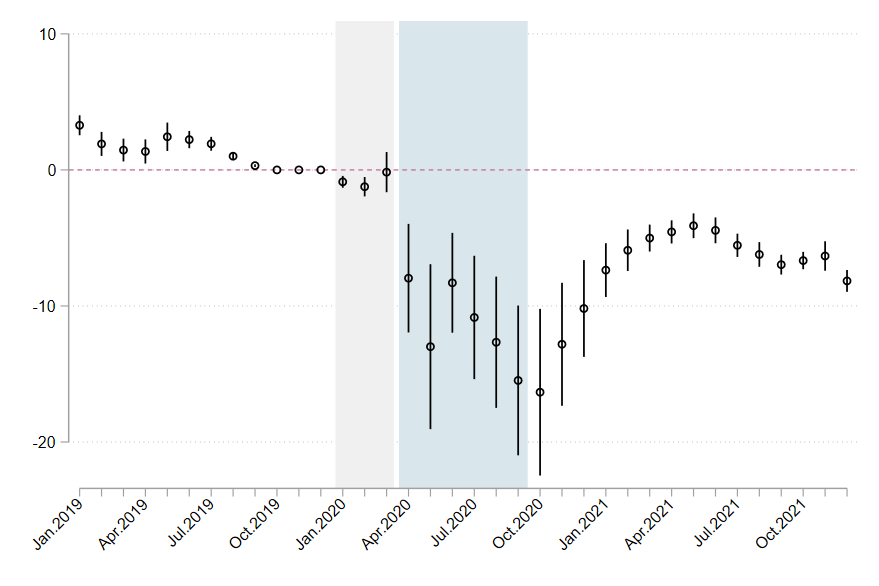

Dynamic relationship between COVID-era migration and municipal bond spreads:

Summary:

- We use COVID-period migration to measure the shift in location preferences induced by the pandemic

- Market participants believe that the shift in preferences poses downside risk to the future of some municipal economies

- The shift in yields associated with a one standard deviation lower migration shock corresponds to a -4.15% to -2.13% change in the present value of cash flows (holding uncertainty fixed) or an increase of 0.93% to 1.62% in uncertainty (holding the present value of cash flows fixed) for the municipality

- Evidence highlights the importance of the shift to remote work in explaining these patterns.

Presentations: Remote Work Conference at Stanford (scheduled), FIFI @ S. Carolina (scheduled), AEA, FCMG

Dynamic relationship between COVID-era migration and municipal bond spreads:

2. Directing the Labor Market: The Impact of Shared Board Members on Employee Flows

with Taylor Begley and Peter Haslag

with Taylor Begley and Peter Haslag

Draft

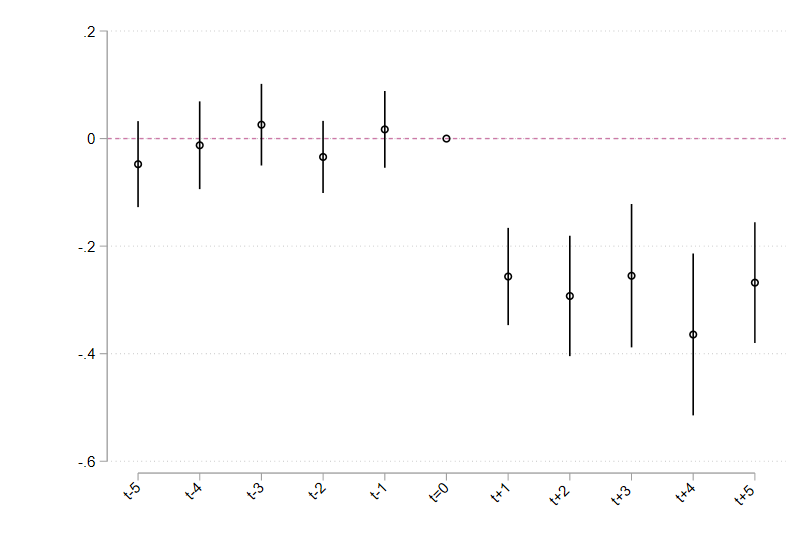

Summary: Using résumé data on millions of U.S. workers, we find that the flow of employees between a pair of firms sharply drops by around 20-30% when the firms start to share a director on their boards. The results suggest that shared directors facilitate cooperative behavior in the labor market.

Presentations: Endless Summer (scheduled), EFA (scheduled), Northeastern Finance Conference, CSFN Conf. on Governance and Sustainability, Bretton Woods Ski Conference, MFA, Santiago Finance Workshop, LFG @ Chicago Fed, Conf. on Empirical Legal Studies @UChicago, Dolomites Summer Finance, Erasmus Corp. Gov., Michigan State, Tennessee, Georgia Tech, Vanderbilt

Coverage: Columbia Law School Blog, ProMarket

Relative flow of employees between a pair of firms around initiation of board overlap (Poisson):

Summary: Using résumé data on millions of U.S. workers, we find that the flow of employees between a pair of firms sharply drops by around 20-30% when the firms start to share a director on their boards. The results suggest that shared directors facilitate cooperative behavior in the labor market.

Presentations: Endless Summer (scheduled), EFA (scheduled), Northeastern Finance Conference, CSFN Conf. on Governance and Sustainability, Bretton Woods Ski Conference, MFA, Santiago Finance Workshop, LFG @ Chicago Fed, Conf. on Empirical Legal Studies @UChicago, Dolomites Summer Finance, Erasmus Corp. Gov., Michigan State, Tennessee, Georgia Tech, Vanderbilt

Coverage: Columbia Law School Blog, ProMarket

Relative flow of employees between a pair of firms around initiation of board overlap (Poisson):

Published Papers:

1. Can Markets Discipline Government Agencies? Evidence from the Weather Derivatives Market

with Amiyatosh Purnanandam. Journal of Finance, 2016, 71: 303–334.

with Amiyatosh Purnanandam. Journal of Finance, 2016, 71: 303–334.

Link to paper

Summary: We analyze the role of financial markets in shaping the incentives of government agencies using a unique empirical setting: the weather derivatives market.

[Published Version]

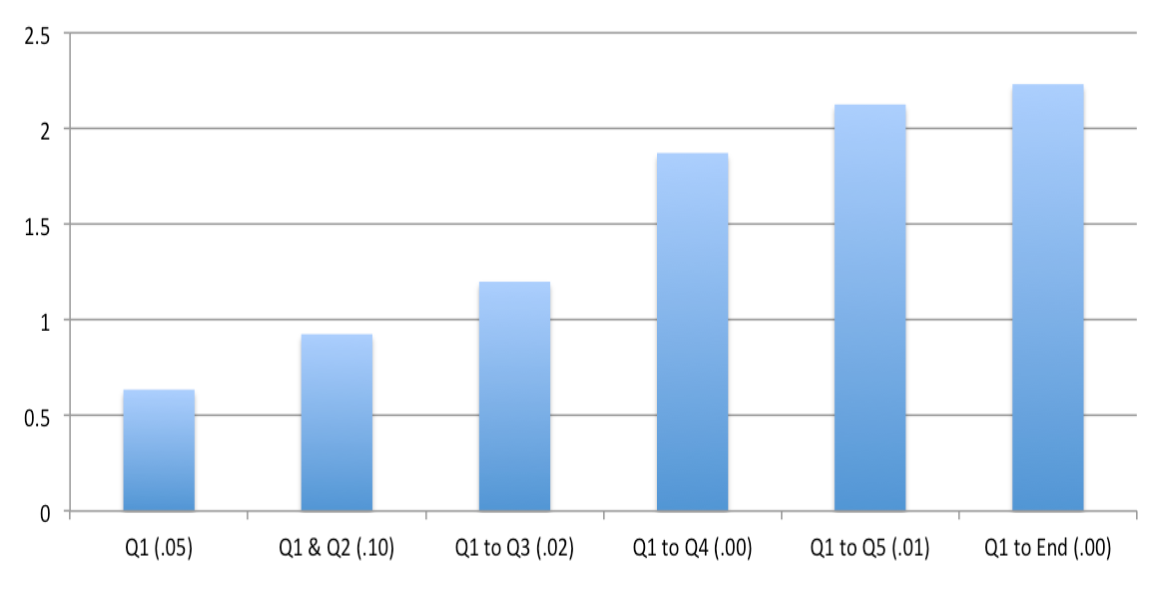

Quarter-by-quarter improvement in NWS temperature measurement error rate post-CME contract introduction:

Summary: We analyze the role of financial markets in shaping the incentives of government agencies using a unique empirical setting: the weather derivatives market.

[Published Version]

Quarter-by-quarter improvement in NWS temperature measurement error rate post-CME contract introduction:

2. Financial Sector Stress and Risk Sharing: Evidence from the Weather Derivatives Market

Review of Financial Studies, 2019, 32(6), 2456-2497.

Review of Financial Studies, 2019, 32(6), 2456-2497.

Link to paper

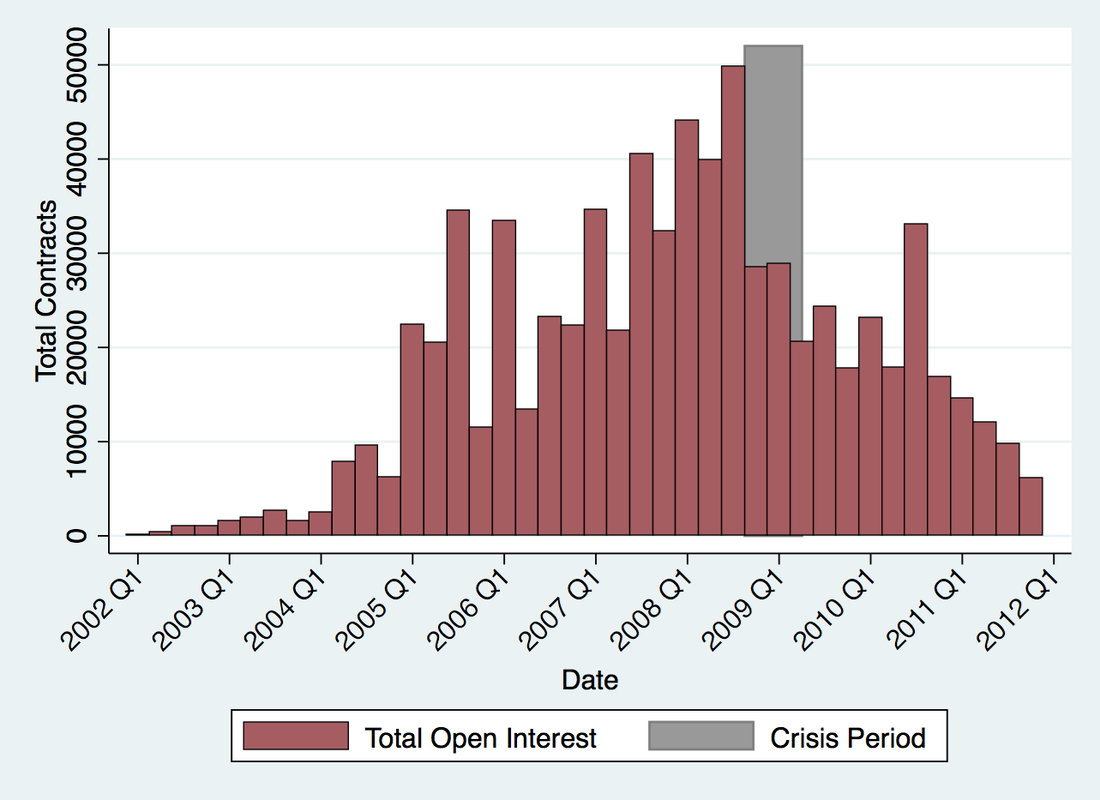

Summary: I examine the effect of financial sector stress on risk sharing in a novel setting: the CME’s weather derivatives market. The results provide causal evidence of the effect of financial sector stress on the pricing of exchange-traded financial contracts and risk sharing in the economy.

[Internet Appendix] [Published Version]

Collapse of Monthly Temperature Futures Market Brought on by the Crisis:

Summary: I examine the effect of financial sector stress on risk sharing in a novel setting: the CME’s weather derivatives market. The results provide causal evidence of the effect of financial sector stress on the pricing of exchange-traded financial contracts and risk sharing in the economy.

[Internet Appendix] [Published Version]

Collapse of Monthly Temperature Futures Market Brought on by the Crisis:

3. Are Monthly Market Returns Predictable?

with Jussi Keppo and Tyler Shumway. Review of Asset Pricing Studies, 2021, Volume 11, Issue 4, 806-836.

with Jussi Keppo and Tyler Shumway. Review of Asset Pricing Studies, 2021, Volume 11, Issue 4, 806-836.

Link to paper

Summary: We document significant persistence in the market timing performance of active individual investors, suggesting some investors are skilled at timing.

[Internet Appendix] [Published Version]

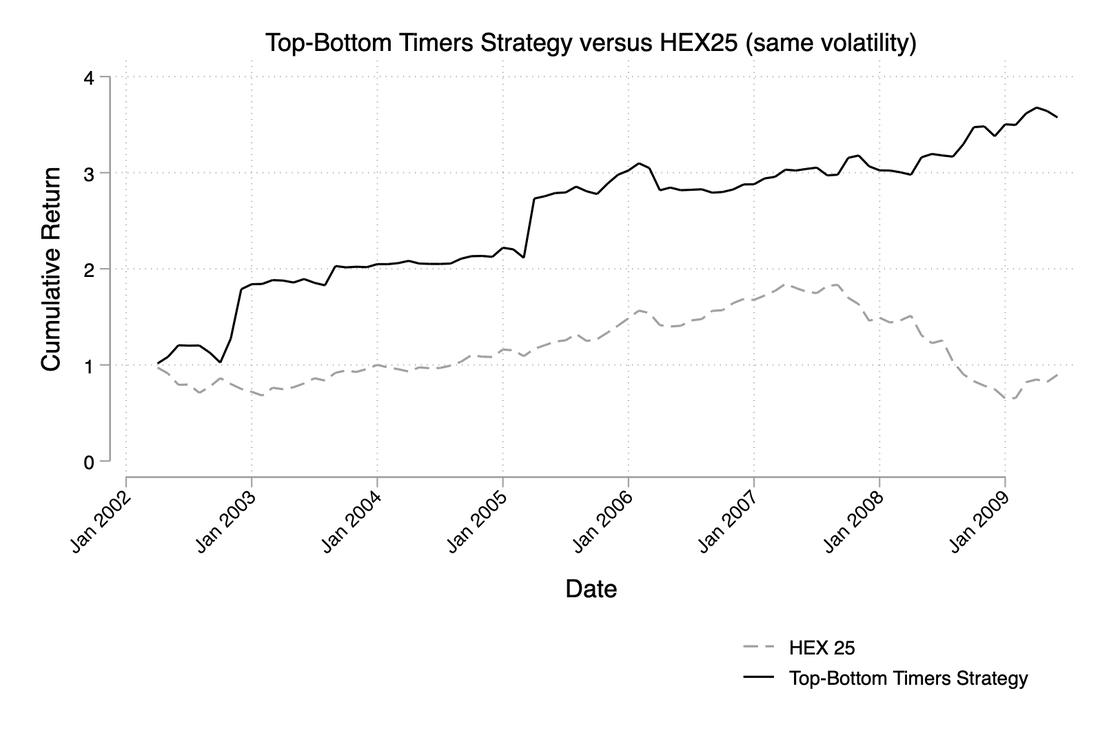

Cumulative return of a scaled trading strategy that mimics the trades of past successful market timers and shorts the trades of past unsuccessful timers:

Summary: We document significant persistence in the market timing performance of active individual investors, suggesting some investors are skilled at timing.

[Internet Appendix] [Published Version]

Cumulative return of a scaled trading strategy that mimics the trades of past successful market timers and shorts the trades of past unsuccessful timers:

4. Revealed Heuristics: Evidence from Investment Consultants' Search Behavior

with Sudheer Chava and Soohun Kim. Review of Asset Pricing Studies, 2022, Volume 12, Issue 2, 543–59.

with Sudheer Chava and Soohun Kim. Review of Asset Pricing Studies, 2022, Volume 12, Issue 2, 543–59.

Link to paper

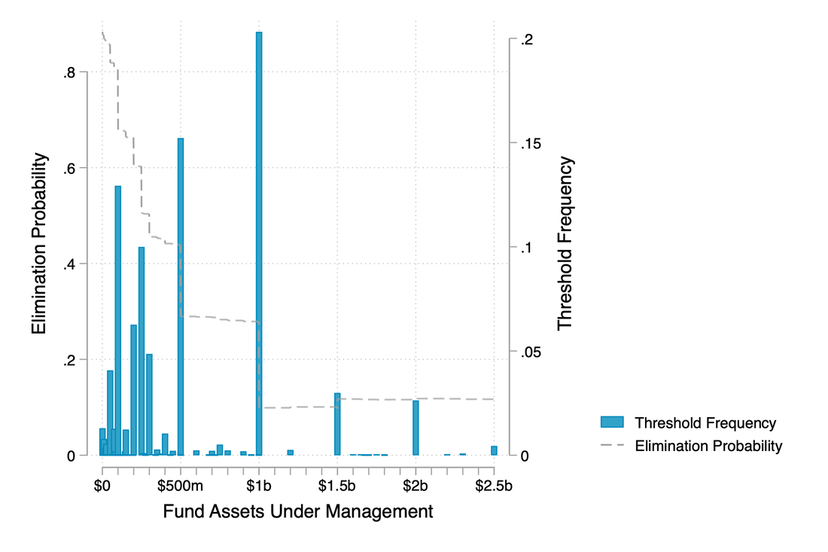

Summary: We find that investment consultants (who advise institutional investors) frequently shortlist funds using threshold screens clustered at cognitive reference numbers (e.g., $500MM AUM, 0% excess returns) and the clustering of screens affects fund outcomes.

[Published Version]

Investment consultant screen frequency and fund elimination probability by fund AUM:

Summary: We find that investment consultants (who advise institutional investors) frequently shortlist funds using threshold screens clustered at cognitive reference numbers (e.g., $500MM AUM, 0% excess returns) and the clustering of screens affects fund outcomes.

[Published Version]

Investment consultant screen frequency and fund elimination probability by fund AUM:

5. Firm Finances and the Spread of COVID-19: Evidence from Nursing Homes

with Taylor Begley. Review of Corporate Finance Studies, 2023, Volume 12, Issue 1, 1-35. Editor’s choice.

with Taylor Begley. Review of Corporate Finance Studies, 2023, Volume 12, Issue 1, 1-35. Editor’s choice.

Link to paper

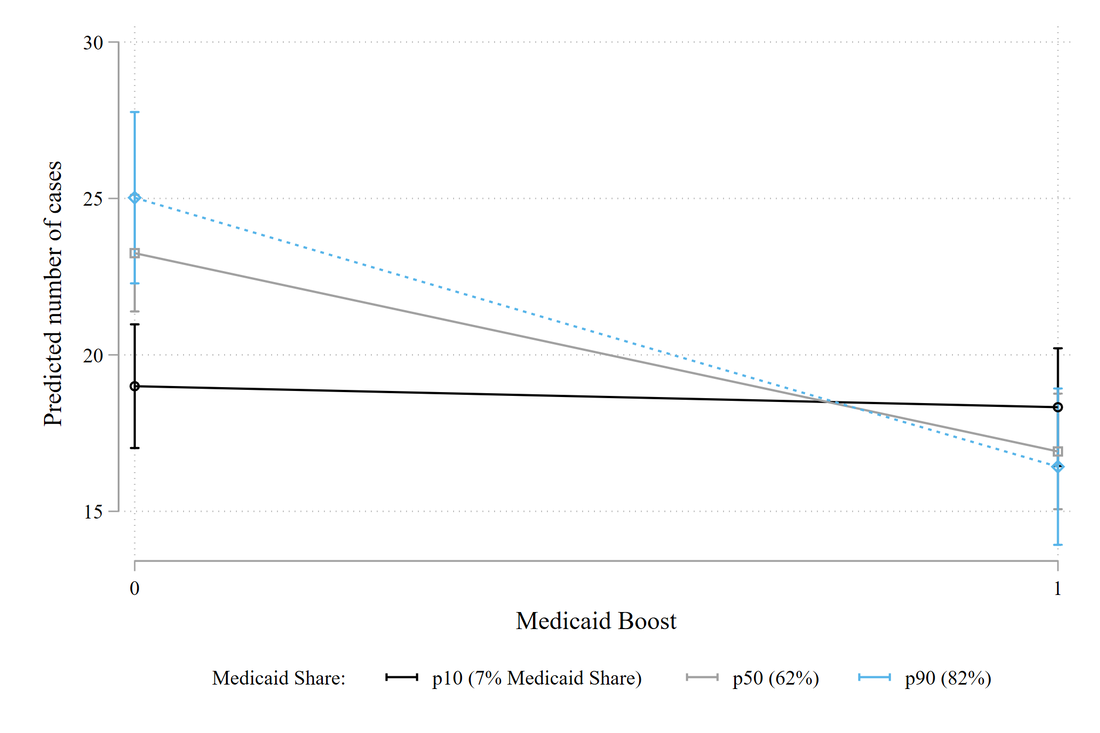

Summary: We find firms’ financial resources play an important role in mitigating the spread of COVID-19 using data on nursing homes. Further, increases in Medicaid reimbursement rates led to relatively better outcomes at facilities more reliant on Medicaid.

[Internet Appendix][Published Version]

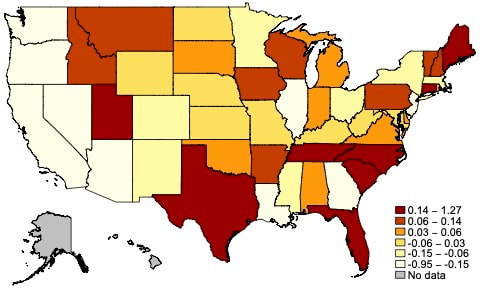

Estimated Impact of Medicaid Reimbursement Expansion on COVID-19 cases:

Summary: We find firms’ financial resources play an important role in mitigating the spread of COVID-19 using data on nursing homes. Further, increases in Medicaid reimbursement rates led to relatively better outcomes at facilities more reliant on Medicaid.

[Internet Appendix][Published Version]

Estimated Impact of Medicaid Reimbursement Expansion on COVID-19 cases:

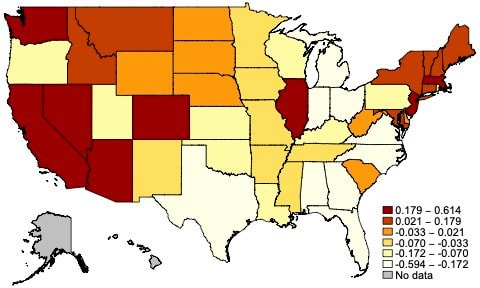

6. From L.A. to Boise: How Migration Has Changed During the COVID-19 Pandemic

with Peter Haslag. Forthcoming, Journal of Financial and Quantitative Analysis.

with Peter Haslag. Forthcoming, Journal of Financial and Quantitative Analysis.

Link to paper

Published Version

Summary: We provide an initial assessment of how migration patterns have changed during the pandemic. Using proprietary moving data, we find high income movers are moving out of large cities and are moving less for job-related reasons and more for non-work related reasons. Areas with greater inflows of high income households during the pandemic also experienced greater economic growth.

Media Coverage (link)

Published Version

Summary: We provide an initial assessment of how migration patterns have changed during the pandemic. Using proprietary moving data, we find high income movers are moving out of large cities and are moving less for job-related reasons and more for non-work related reasons. Areas with greater inflows of high income households during the pandemic also experienced greater economic growth.

Media Coverage (link)

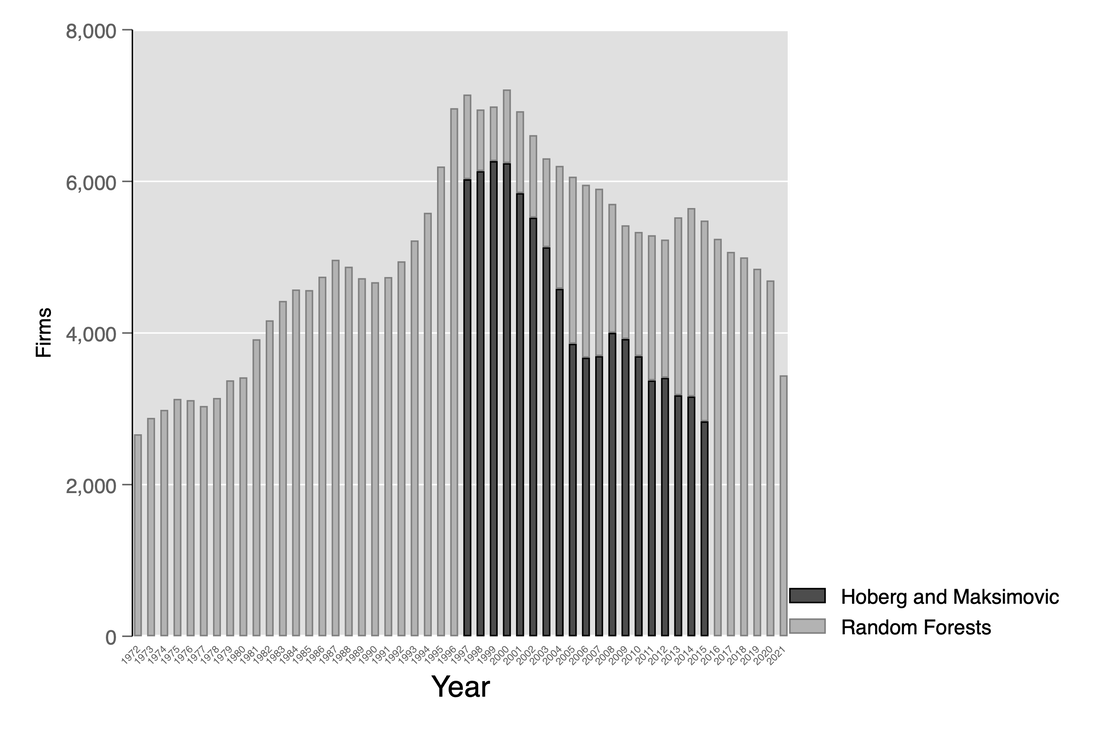

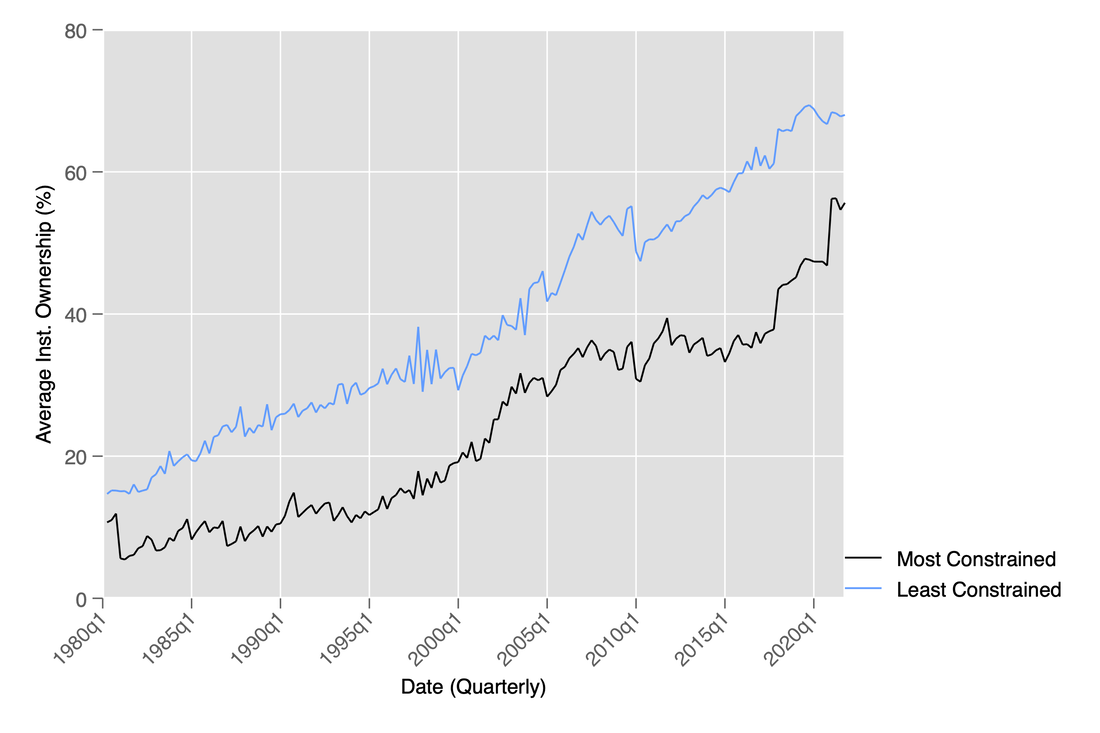

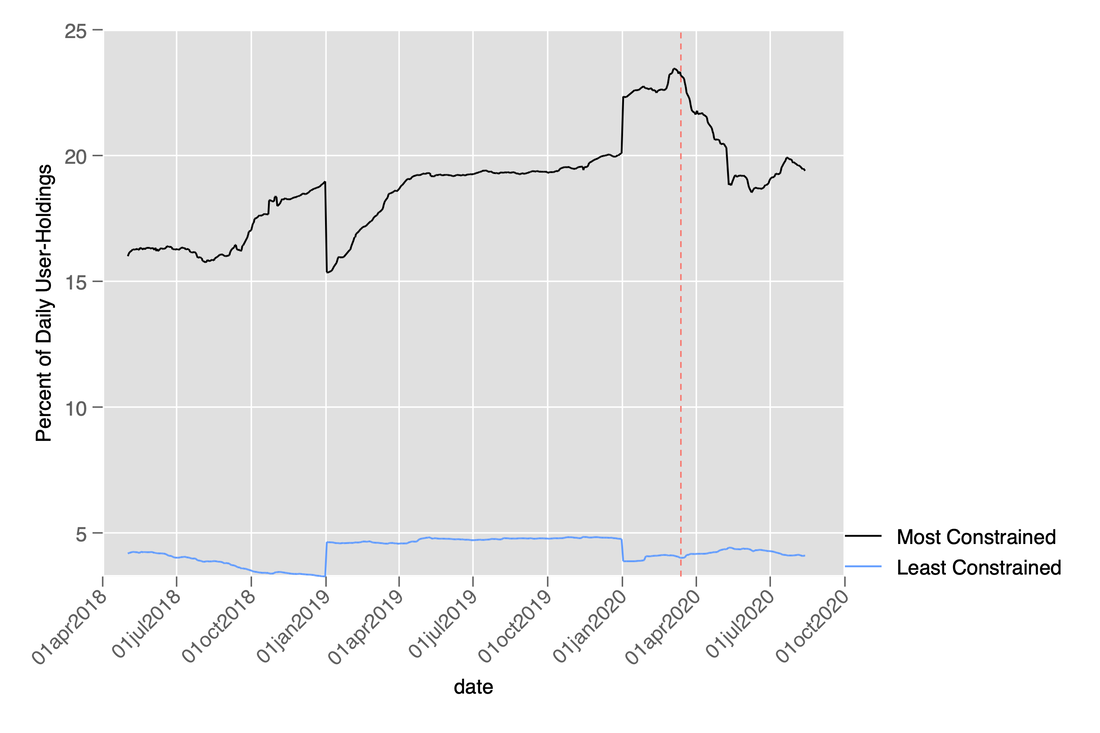

7. Uncovering Financial Constraints

with Matt Linn. Forthcoming, Journal of Financial and Quantitative Analysis.

with Matt Linn. Forthcoming, Journal of Financial and Quantitative Analysis.

Data

Link to Published Paper

Link to SSRN-Version

Internet Appendix

Main Figures: extended coverage of our measure. Robinhood (& other retail) investors tend to favor equity constrained stocks.

Summary: We classify firms’ financial constraints using a random forest model. We create two versions of our measures: a "Full" model that uses many predictors and an "Exogenous" model using a small set of arguably exogenous predictors. We find institutional ownership is negatively associated with equity-related constraints, while retail investors exhibit a preference for equity-focused constrained firms. Further, we find the equity issuance and investment of equity-constrained firms increase in periods of high investor sentiment.

Link to Published Paper

Link to SSRN-Version

Internet Appendix

Main Figures: extended coverage of our measure. Robinhood (& other retail) investors tend to favor equity constrained stocks.

Summary: We classify firms’ financial constraints using a random forest model. We create two versions of our measures: a "Full" model that uses many predictors and an "Exogenous" model using a small set of arguably exogenous predictors. We find institutional ownership is negatively associated with equity-related constraints, while retail investors exhibit a preference for equity-focused constrained firms. Further, we find the equity issuance and investment of equity-constrained firms increase in periods of high investor sentiment.

8. Disaster Lending: "Fair" Prices, but "Unfair" Access

with Taylor Begley, Umit Gurun, and Amiyatosh Purnanandam. Forthcoming, Management Science.

with Taylor Begley, Umit Gurun, and Amiyatosh Purnanandam. Forthcoming, Management Science.

Link to paper

Published Version

Summary: We find that under risk-insensitive loan pricing – a feature present in many government programs – marginal credit quality borrowers are less likely to receive credit in the SBA disastpubsonline.informs.org/doi/full/10.1287/mnsc.2021.03199er loan program. We model the loan decision of a government lender and show how access to credit varies with the loan program's subsidy and degree of risk-sensitive pricing.

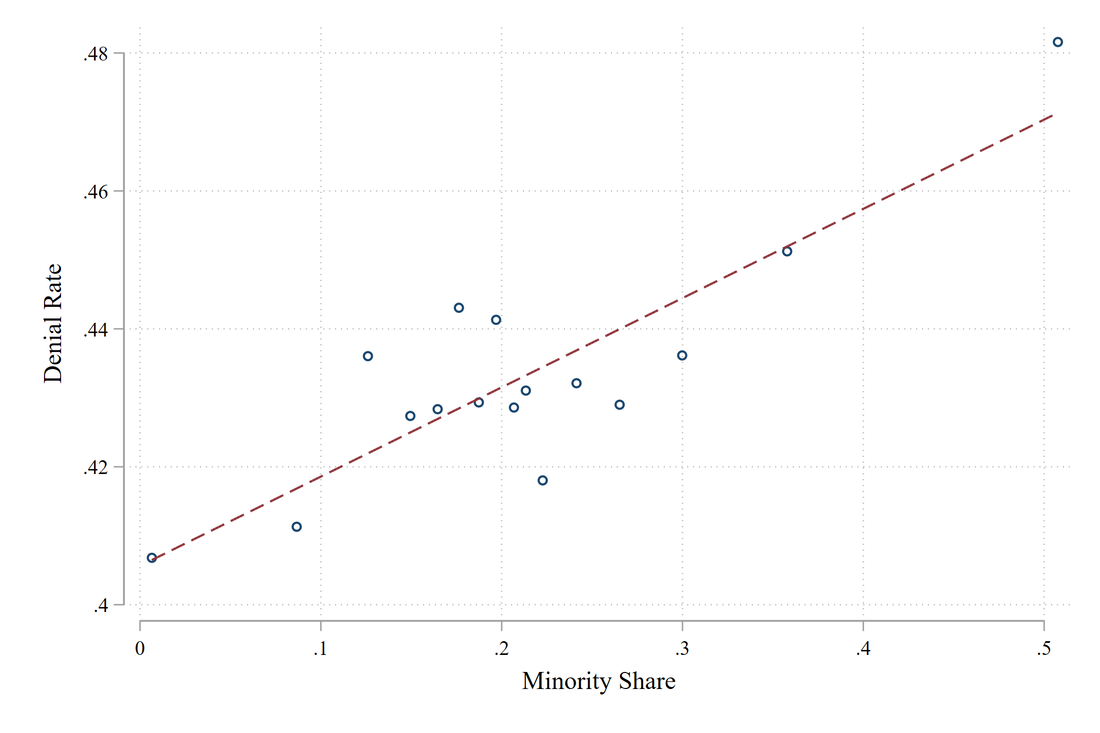

Relationship between the minority share of applicant county and SBA disaster loan denial rate:

Published Version

Summary: We find that under risk-insensitive loan pricing – a feature present in many government programs – marginal credit quality borrowers are less likely to receive credit in the SBA disastpubsonline.informs.org/doi/full/10.1287/mnsc.2021.03199er loan program. We model the loan decision of a government lender and show how access to credit varies with the loan program's subsidy and degree of risk-sensitive pricing.

Relationship between the minority share of applicant county and SBA disaster loan denial rate:

9. Long-Run Labor Costs of Housing Booms and Busts

with Taylor Begley and Peter Haslag. Forthcoming, Journal of Financial and Quantitative Analysis.

with Taylor Begley and Peter Haslag. Forthcoming, Journal of Financial and Quantitative Analysis.

Link to Published Version

Link to SSRN Version

Summary: We study individual labor market decisions during the house price run-up of the early 2000s using the career paths of nearly 7 million workers. We find severe negative long-run outcomes for individuals that enter realty in areas with higher non-fundamental house price growth.

Presentations: ATL Fed/GSU Real Estate, FDU, RCFS/RAPS, Stockholm LFG, EFA

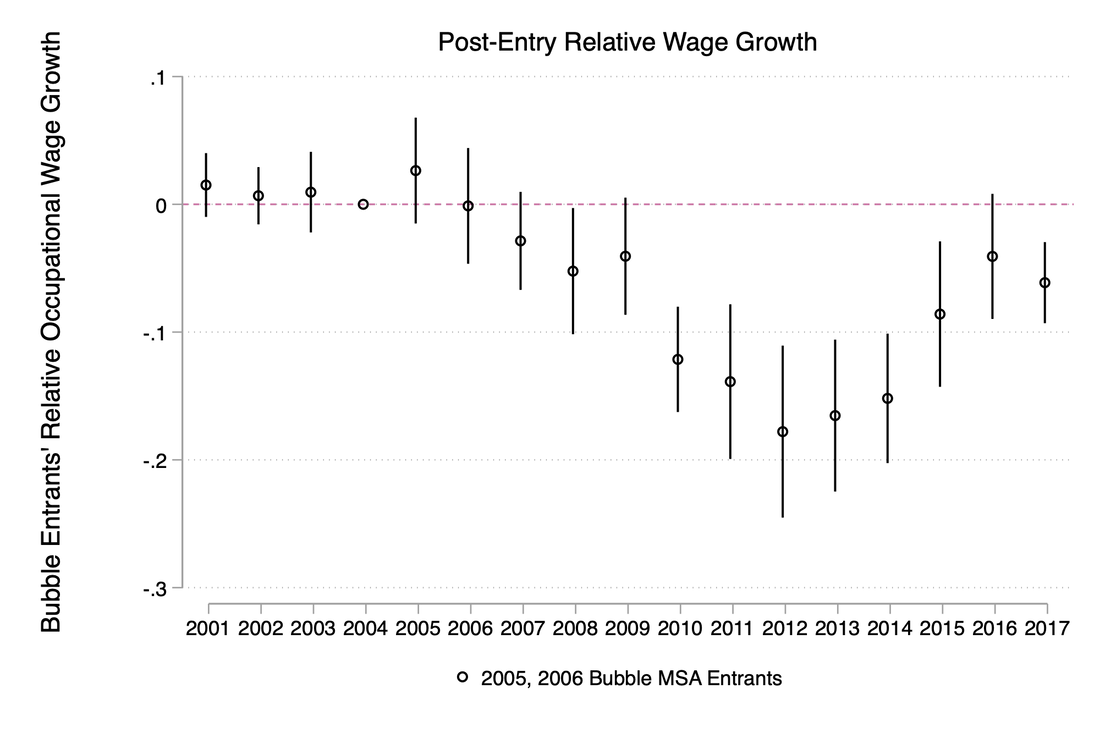

Relative occupational wage growth for Bubble MSA entrants into realty during 2000s boom:

Link to SSRN Version

Summary: We study individual labor market decisions during the house price run-up of the early 2000s using the career paths of nearly 7 million workers. We find severe negative long-run outcomes for individuals that enter realty in areas with higher non-fundamental house price growth.

Presentations: ATL Fed/GSU Real Estate, FDU, RCFS/RAPS, Stockholm LFG, EFA

Relative occupational wage growth for Bubble MSA entrants into realty during 2000s boom: